Why Mergers and Acquisitions Advisors Are Important for Successful Bargains

Mergers and procurements experts play a crucial duty in navigating the complexities of corporate transactions, making sure that bargains are not only tactically audio but additionally monetarily feasible. Their proficiency encompasses critical elements such as assessment, settlement, and due persistance, which jointly alleviate threats inherent in these high-stakes settings.

Recognizing M&A Advisors' Roles

Mergers and acquisitions (M&A) advisors play a critical duty in facilitating complicated transactions between business. Their proficiency is essential in navigating the elaborate landscape of business mergings, acquisitions, divestitures, and joint endeavors. M&An experts are typically involved by firms looking for to either obtain or offer properties, offering indispensable understandings that help inform strategic choices.

Among the main responsibilities of M&An advisors is to perform extensive due diligence, which involves assessing the economic, operational, and lawful elements of the target firm. This procedure is crucial for determining potential dangers and chances, ultimately sustaining notified decision-making. In addition, M&A consultants help in structuring the offer, ensuring that it straightens with the tactical objectives of the entailed parties while maximizing worth.

M&A consultants help in safeguarding financing and navigating regulatory demands, streamlining the process to achieve an effective deal. Their complex duty is crucial in driving value creation and ensuring beneficial results in M&A tasks.

Benefits of Professional Valuation

Accurate appraisal is a fundamental component of successful mergings and procurements, as it provides a clear understanding of a firm's worth and assists establish sensible expectations for all parties included. Professional appraisal services use many advantages that improve the M&A process.

Firstly, skilled experts make use of detailed methods and sector benchmarks to get here at an unbiased evaluation. This decreases the probability of overestimating or underestimating a business's worth, cultivating count on amongst stakeholders. Specialist evaluations are important in recognizing abstract properties, such as brand equity and intellectual property, which might not be reflected in typical economic statements however significantly effect overall well worth.

Furthermore, precise evaluation help in critical decision-making. By understanding the real worth of a company, firms can straighten their goals, making sure that procurement targets or divestitures are sought based on audio economic reasoning. Specialist evaluations are essential for working out beneficial offer terms, as they supply a solid foundation for discussions.

Eventually, leveraging professional valuation services not just enhances the credibility of the transaction but also lessens dangers related to mispricing, making it an indispensable component in the M&A landscape.

Settlement Methods That Issue

Successful settlements in mergings and procurements rest on the reliable strategies utilized by consultants to accomplish beneficial outcomes. One important method is preparation, which involves event thorough details about both events, sector trends, and potential harmonies. transaction advisory services. This foundation permits experts to recognize utilize points and potential objections

One more crucial method is energetic listening, which makes it possible for experts to comprehend the interests and inspirations of the opposing celebration. By comprehending these subtleties, consultants can craft proposals that straighten with the various other side's goals, cultivating goodwill and increasing the possibility of an effective offer.

Utilizing strategic examining likewise plays an essential function in negotiations. Advisors can use open-ended inquiries to urge dialogue, discover options, and probe for underlying concerns that may not be instantly noticeable. This strategy can uncover chances for concession and innovative options.

Value of Due Persistance

Conducting due diligence includes scrutinizing financial statements, tax records, contracts, and conformity with guidelines, as well as assessing the target's monitoring team and company society. This thorough evaluation assists buyers comprehend real value of the target and ensures positioning with their tactical objectives.

Additionally, due persistance provides an opportunity for vendors to display their staminas and resolve any type of weaknesses before negotiations finalize. By identifying locations for renovation, firms can bolster their appearance to prospective customers.

Fundamentally, the due diligence stage not only educates rates and settlement methods however likewise fosters openness between parties. This openness is essential for building count on, which can significantly influence the success of the purchase. Eventually, the persistance process is important in reducing surprises post-acquisition and prepares for a successful assimilation.

Mitigating Dangers in Transactions

To start with, complete due persistance is an important part of danger mitigation. Advisors have the knowledge to look at monetary declarations, assess market conditions, and review possible obligations. This extensive evaluation aids in revealing covert threats that might not be promptly obvious.

Additionally, M&An advisors play an essential role in working out terms that safeguard both parties. By establishing clear contractual arrangements, they can minimize misunderstandings and guarantee compliance with regulatory demands, therefore decreasing legal exposure.

Additionally, advisors frequently apply danger administration techniques that consist of contingency planning and integration roadmaps - transaction advisory services. These frameworks make it possible for companies to navigate post-transaction difficulties successfully, protecting worth and promoting a smoother shift

Conclusion

In conclusion, the experience of mergers and procurements consultants is crucial for attaining effective transactions. By facilitating communication between parties and making sure Visit Your URL compliance with go to this web-site governing requirements, M&A consultants promote an environment of depend on and openness.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Michael Fishman Then & Now!

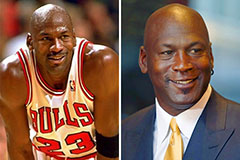

Michael Fishman Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now!